International rollout is hard for startups. There are complex, tough questions to sort though: legal regulations, cultural differences, language and interface barriers to name just a few.

And then there are issues that are really, really easy to fix. Those shouldn’t get in the way.

One of them is invoicing. There are some questions there that are not completely trivial, like when to charge VAT and how much. Asking your tax advisor might be the only way to sort out these questions, but you can do this gradually whenever a new situation comes up. So over time you build a knowledge base (template base even) that makes it easier over time. But most of the time, invoicing is easy.

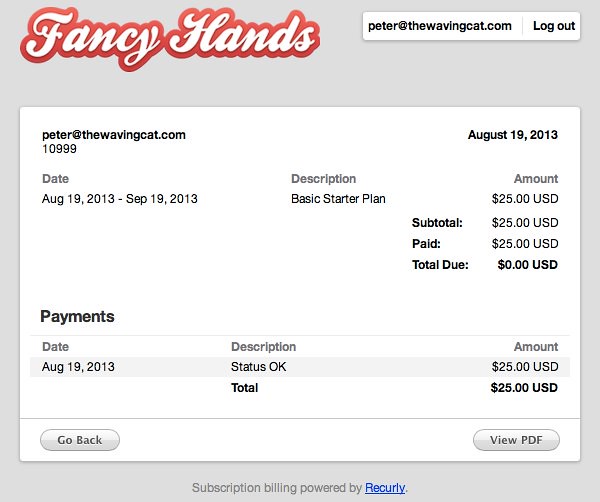

Here’s an invoice generated by FancyHands (with the help of Recurly):

Screenshot of FancyHands invoice, lacking all kinds of information to meet German legal requirements.

Screenshot of FancyHands invoice, lacking all kinds of information to meet German legal requirements.

Note that there’s not even information in there that I need to edit out in the image? About me, it contains ONLY a zip code and email address. About FancyHands, only the logo.

More importantly, it doesn’t mention how I paid, or what company is behind FancyHands’ logo, or where my company is registered.

(At least it does mention the amound and the currency (USD), which is a start. Also, a date.)

Earning money with a startup is possible. In fact, for this service I happily paid. (I even wrote a lenghty, indepth side by side comparison of FancyHands and local competitor AskGeoffrey.) What you really don’t want to get in the way of earning money is your invoices.

Getting invoice templates isn’t a hard problem to solve. Include more information — the company knows its own address, and mine, too — rather than too little, and you’ll be set for most jurisdictions. Otherwise your customers will go to the local competitors.

As an extra service, here’s a list of requirements as researched by FancyHands own researchers on my behalf. I didn’t double check, so use at your own risk. It does look pretty ok, though:

—

Reference http://fncy.it/14FKtW6 (proz.com) Information that invoices must contain

- Full name of the service provider.

- Complete address of service provider.

- Full name of recipient.

- Complete address of recipient.

- Service provider’s tax number (Steuernummer) or VAT ID (for those liable for VAT).

- Recipient VAT number, if recipient is VAT-registered.

- The date of issue of the invoice.

- For all invoices, a unique (alpha)numerical identifier (a simple serial number suffices).

- A brief description of the service(s) provided.

- The date or period during which the service was provided.

- An itemised list of each service provided with the unit price (e.g. €65 per hour), the total amount for each service, and the grand total, or a fixed charge, without VAT.

- For a final invoice, all advance payments (for which invoices also have to be issued).

- The amount of VAT and the rate applied. If VAT does not apply (only for those liable for VAT), a simple statement explaining why.

- The (grand) total including VAT.

- Any discount granted before VAT and the discount rate applied.

—

TL;DR: Some problems are hard to solve. Invoicing isn’t.